How Much Money To Withhold For Taxes Independent Contractor

Image source: Getty Images

Independent contractors are one-person businesses and remit taxes on their own. Follow these five steps to file your contained contractor taxes.

Independent contractors play a pregnant part in the U.South. economic system, at least for at present. From your cab driver to your nutrient delivery person, you interface with independent contractors every day. Y'all might even be an contained contractor. Fifty-fifty I'm an contained contractor!

Unlike employees, independent contractors remit revenue enhancement payments on their own. I'll say that at least two more times in this commodity because it's only that of import. Here's how you pay taxes every bit an independent contractor.

Overview: What is an independent contractor?

Independent contractors are one-person businesses that provide goods and services to clients for a fee. People and companies engage independent contractors for a specific work purpose, relying on their expertise to complete the work.

Whereas employers tin accept significant control over their employees' work processes, a business cannot dictate how and what its independent contractors exercise to achieve the business'due south desired result.

The U.S. regime has been cracking down on contained contractor classification in cases where workers could be treated more similar employees.

You might accept heard nigh how the California legislators accept impugned the fashion Uber and Lyft classify their drivers. Cheque out our guide on independent contractors vs. employees for more on the difference betwixt the two classifications.

One major divergence is that businesses don't pay or withhold payroll taxes for independent contractors, who are as well chosen 1099 contractors. As self-employed workers, independent contractors remit taxes on their own.

Additionally, since contained contractors are business owners, they can accept tax deductions for expenses incurred to consummate their work, merely like any other business organisation tin can.

Tax deductions for independent contractors

As an contained contractor, you tin deduct reasonable and necessary expenses related to running your business. Tax deductions reduce net income, lowering your business organisation tax bill.

At your disposal are the same deductions available to whatsoever small-scale business. Yous can browse our guide to small business organization tax deductions for a more comprehensive list of deductible expenses, but here are a few telephone call-outs for contained contractors.

- Home office deduction: Independent contractors who use a portion of their domicile for work -- and no other purpose -- can deduct either $5 per square foot, up to 300 square feet, or the actual expenses of their home part. Don't endeavor to claim your kitchen table or an office you apply for your total-time, non-contract chore; the IRS doesn't look kindly on that.

- Cocky-employment taxes: Employees pay ane-half of Federal Insurance Contribution Act (FICA) taxes, and their employer picks upward the other half. Contained contractors must pay 15.3% of eligible earnings to FICA, but they can deduct the one-half employers typically pay.

How to pay taxes every bit an independent contractor

Paying taxes on your ain tin seem stressful if you're unfamiliar with the procedure. Your best bt is to get organized, employ tax software, and follow these five steps.

1. Register your business and get accounting software

Yous're a business organisation owner, Harry! Register your business to take reward of legal and financial protections and the power to split up your personal and work finances.

Before you register your business, you're considered a sole proprietor. This is suitable for many freelancers considering information technology requires no setup.

When yous register your business, you can get an Employer Identification Number (EIN), which allows you to open a business bank business relationship and credit lines. That makes revenue enhancement fourth dimension easier: You lot won't be wondering if the Chipotle charge on your credit carte was for a personal or work burrito.

Many independent contractors annals equally limited liability companies, which tin can limit personal liability in business dealings. While LLCs tin be taxed in many ways, you shouldn't elect any funky tax treatment unless you'd like to complicate your tax render.

By default, single-member LLCs are pass-through entities that pay and file taxes just similar sole proprietorships -- no separate taxation return, zip special. Information technology'due south the ideal choice for nearly independent contractors.

Once you gear up upwardly your legal business, start using accounting software to track your revenues and expenses. It'll come in handy when you're verifying your earnings and filing your taxes.

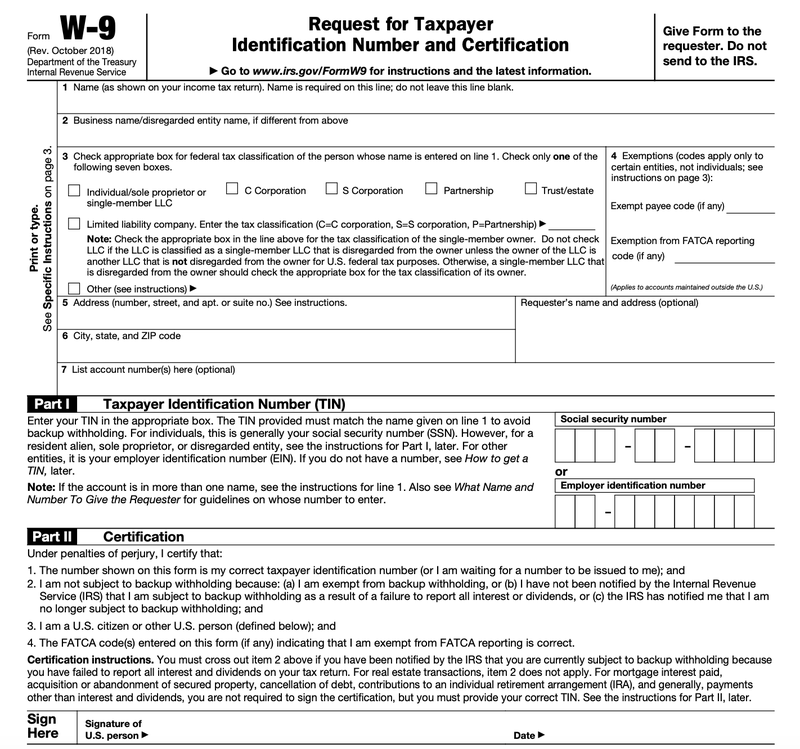

two. Fill out and save a Form Westward-9

Virtually all of your business clients will ask you for your Class W-9, which collects your legal proper noun and taxpayer identification number (TIN). It'due south best to fill it out in one case, save it, and send it to your clients equally they request it.

Businesses use the data on your Course W-9 to file your Form 1099-NEC, which reports payments made to independent contractors that exceed $600 for the year.

Independent contractors who practise not provide a right TIN to their business clients might be field of study to fill-in withholding, where the customer withholds and remits to the IRS 24% of an independent contractor's fee. Double-check your Tin earlier sending it to a customer.

Form W-9 collects an independent contractor'south legal proper noun and taxpayer identification number (TIN). Image source: Author

It's ane of the simplest forms the IRS has to offer. If yous created a single-member LLC, y'all should register for an EIN to avoid sharing your Social Security Number (SSN) or individual taxpayer identification number (ITIN) with clients.

The IRS occasionally alters Form West-9, so make sure the one yous transport clients is the most contempo version.

iii. Make estimated revenue enhancement payments

Independent contractors are required to remit their own taxes. If you expect to owe more than $1,000 when you file your taxes, y'all're required to make quarterly tax payments.

If you run a modest business on the side while employed somewhere that withholds federal income taxes from your paycheck, avoid quarterly payments by increasing your federal withholding. You can adjust your federal withholding by filling out and submitting a fresh Form W-2 to your employer.

Employ Form 1040-ES to calculate and brand IRS estimated tax payments. Payment can exist submitted online or by mail service.

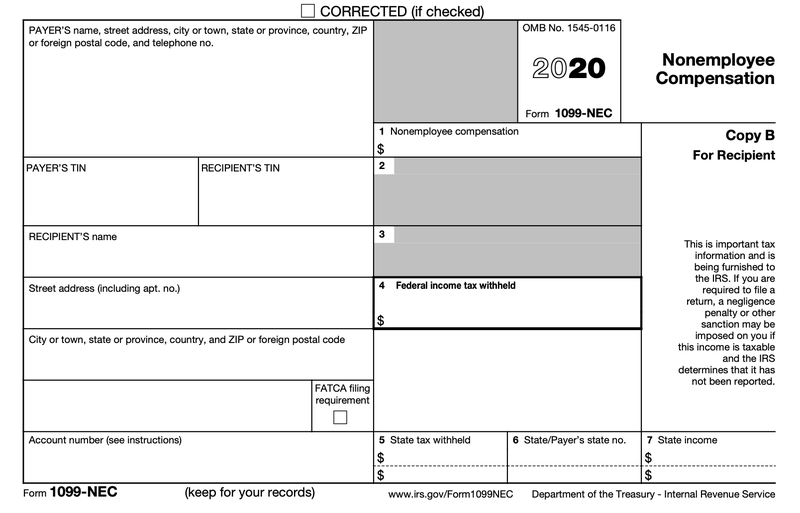

4. Receive Forms 1099-NEC from clients

At the beginning of each twelvemonth, expect to receive a Form 1099-NEC from every business customer who paid you more than $600 final year.

Compare the amounts on the forms to your accounting records. Brand sure every amount matches, and contact your client when there are discrepancies.

Businesses file Class 1099-NEC for contained contractors paid more than $600 in the yr. Image source: Author

But don't await a Form 1099-NEC from every client: Non-business organisation clients don't accept to file anything when they pay y'all.

Permit's say yous create topiaries for a living, and your neighbour paid you $750 to make a topiary in the shape of her granddaughter. Your neighbor won't file a 1099 tax class considering the topiary isn't for a piece of work purpose.

If your client were a real estate programmer, withal, they'd have to send you a Grade 1099-NEC for the beautiful topiary you made for their building's front lawn.

For the past 38 years, businesses filed Form 1099-MISC to report payments to independent contractors. Form 1099-NEC replaces 1099-MISC for this purpose starting in 2020.

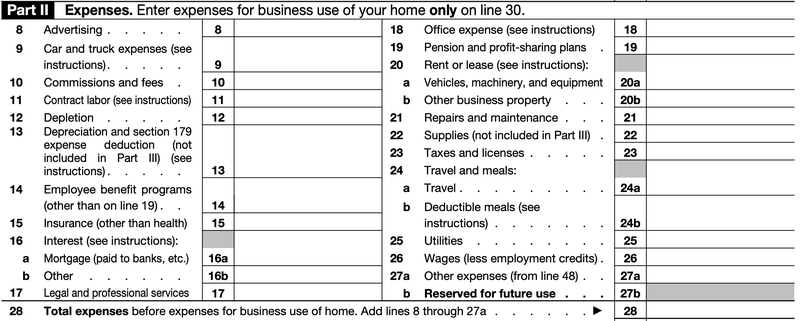

five. File Form 1040 and appropriate schedules

Contained contractors use Grade 1040 to report and pay their small business taxes. Sole proprietorships and single-member LLCs report business income on Schedule C.

Report your business deductions in part two of Class 1040 Schedule C. Paradigm source: Author

Have your bookkeeping software open as you file your business taxes. Tax software can help you identify additional business tax deductions reported in function ii of Schedule C.

FAQs

-

Generally, you should brand tax payments by January 15, April fifteen, June 15, and September 15. However, due dates have been extended this year due to the COVID-19 pandemic.

-

In full general, tax underpayment penalties kick in when you lot owe more than $i,000 in unpaid taxes. You can avoid penalties when y'all pay the smaller amount of:

- ninety% of this yr'due south tax liability

- 100% of last year's tax liability

For example, say you paid $10,000 in taxes concluding year. If you make four equal payments of $2,500 during the year, y'all should avoid underpayment penalties, regardless of this year's income.

Always put aside enough money to pay your taxes. Don't await to brand large revenue enhancement payments once a twelvemonth -- divide your estimated annual taxation liability by 4 and make quarterly payments.

-

The self-employed pay federal, country, and local income taxes. They also pay both halves of FICA taxes, which add upward to 15.3% of eligible earnings: 12.four% to Social Security and 2.ix% to Medicare.

Employers usually cover half of FICA taxes, merely the self-employed pay both parts. Independent contractors can deduct the employers' one-half of FICA when they file their taxes.

Independent contractors don't pay federal or country unemployment taxes, and they're often unable to benefit from unemployment compensation programs.

Independent, but not alone

You may be a ane-person business concern, but you lot should never feel solitary when filing your business organisation taxes. Get some accounting and tax software to help y'all organize your independent contract business finances.

Source: https://www.fool.com/the-blueprint/independent-contractor-taxes/

Posted by: lacysaydrund68.blogspot.com

0 Response to "How Much Money To Withhold For Taxes Independent Contractor"

Post a Comment