How To Get Bank Statement Online

Banks play a key in our personal finance. There is a deposit and withdrawal of cash in an account. We go to the bank depending on our convenient time. It is essential to update the bank account passbook. There is a bank statement of the transactions. The article will help to understand what is a bank statement of the account.

We find our financial activities in the statement. Today, the world has become digital. The customers get the transaction records online. The online ways are text messages, E-mails, bank apps, and more. We will learn about the online bank statement. Scroll down for more information.

What Is a Bank Statement?

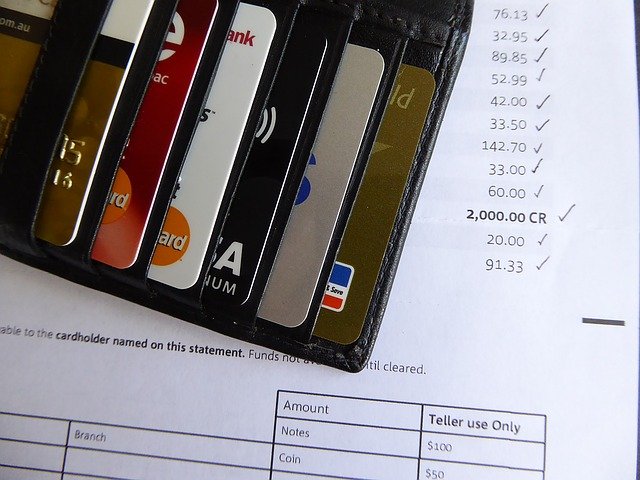

The bank statement is a cash transaction details of a person. The customer views the transaction in the passbook or online.

The banks and financial institutions form the bank's statements. The customer has the traction record through the official system. People view other relevant information like interest.

It is vital to know the daily transaction of the account to save cost. The banks issue the statement to the customer once in the month. The reports help us understand spending habits and financial balance. A person should understand what does a bank statement look like online or offline. The bank statement provides the following details:

- The bank's statement shows the interest earned on current or fixed deposits.

- Checks withdrawal by the payee. There is a deduction in the bank balance.

- Cash withdrawal for various expenditures or ATMs.

- Users of the account come to know the penalties and fees for various reasons.

- The customer finds the bank balance in the bank statements.

There are three parts to the statement of the account. It includes details of the account and personal information. Personal information consists of the name, contact, address of an account holder.

The personal details of the account holder are on the first page of the passbook. People view the transactions of the past years.

How Does a Bank Statement Work?

There is a systematic process in the bank statement. The user needs to understand what's a bank statement? A bank statement summarizes a financial transaction.

The customers of the bank receive the bank statement once a month. People have the option to download their bank statements. There are official websites of private and government banks. They should type their bank account number and pin.

Some banks provide only bank statements online. The customers do not enjoy the other online facilities. People have different accounts in the banks. It depends on the type of account. The account holder may receive joint or separate statements.

There are different formats and details in the bank statements. We find dates on each statement of the bank. The customer finds the amount and date details in the bank transactions. The accounts' holder has the information about the payer and receiver. He/she has the data of deposit and withdrawal.

Deposit Details Include:

- There is an electronic transfer. It involves NEFT, RTGS online, or offline details.

- The account holder gets to know about the bounced checks.

- The bank's statement mentions the payment of credit bills for the customers.

- The customer knows the direct deposit record.

- Deposit of checks as per the dates.

Withdrawal Details Include:

- Details of the electronic transfer to the payee.

- Payment purchases made by the customers.

- The bank statement facilitates the customers to know the bank charges.

- Many times, the customer withdraws cash from the ATM. He/she finds the details in the bank system.

- Some customers do the auto-payment setting. They have the option to know the auto payment details.

How Long to Keep Bank Statements?

The banks have the duration to keep the bank statements. The record is available at a particular time. It depends on the policy of the banks. The bank knows how to make a bank statement of the customer. The account holder needs to ask and learn about the policies of the banks.

Banks keep the statement record for the five years. The account needs to access the document in that time frame. The banks like Wells Fargo keep the statement record for seven years.

The statement includes deposits of the customers and checks data. Some customers are getting only 12 months of financial statements. It is from some card companies.

Many customers use bank statements for their benefit. They use it as proof for filing tax returns. The account holder needs to keep the digital and paper copies. It is wise not to the banks at 100%. Keeping the bank statement is essential.

The bank account of the person is online. The customer will find the record online. In other situations, people need to request and wait for the order of the bank.

He/she should have the document for at least seven years. The banks provide an online facility for tracking the transaction statements. A person has a digital or paper record. He/she does not need to follow it online.

Example:

American Express keeps three years of the transaction record. The chase bank maintains a transaction record of 7 years. The customer has an option to view in 7 years.

Statement records are not crucial after specific years. The account holders need to throw the papers out. If they are digital copies, he/she needs to delete the files.

The digital technology of Apple Mac and window is beneficial. They ensure other people do not recover the files.

Paper or Electronic Bank Statements

The financial sector has gone through digital services. Many customers prefer the paper method in the bank statements. The digital has made the process fast and smooth. Young people think only older customers prefer paper statements.

Read the reasons a customer of all ages may want a paper statement:

It is easy for the customer to maintain the paper documents. Some people ask for the paper document of the bank statements.

Every customer does not have high-speed internet for the bank statement. They're people who live in remote areas. Some customers earn less income. They depend on the paperwork rather than the digital process.

There are chances of cybercrime like data hacking in digital systems. There are no cyber threats in the paperwork statement. People are there to remove the bank offer if they come to know.

There is a HTML5 system in the statement. The account holder interacts with the bank statement. The E-statements are present on the official website of the banks. It is similar to net banking.

Mobile devices are common in today's world. People have the option to view transactions in their homes or at any place.

Customers have a facility to form a budget as per the e-statement. People confirm the expenses to save the optional cost. The bank's user experiences smooth and fast operations.

Frequently Asked Questions (FAQs)

How do I get a bank statement?

It is easy for the customer to get a bank statement copy. The online process on the website will show the state. The customers download the PDF. He/she has the option to contact customer service.

What is an example of a bank statement?

Example:

The bank account shows the opening balance of $2500. The total deposit of the user is $5000. The withdrawal of that user is $2500. The bank statement will show the transaction entries. The entries involve withdrawal, deposit, and opening balance.

Why do I need a bank statement?

We need a bank statement to track the finances. It helps to recognize the error and form saving habits.

Can I get a bank statement at the bank?

The customer gets the bank statement if they request the same. The bank may charge $6 for statement service. The account holder has the option to contact customer service. The customer gets a copy of the bank statement.

Is it safe to give a bank statement?

The primary goal of the bank statement is to ensure safety for the customers. The bank's statements will not affect the business or financial security.

Conclusion

A bank statement is the summary of the financial transaction of a person. A person may have savings or a current account. It helps us to prepare a helpful budget.

It is helpful if we know what is a bank statement in our accounts. We have the option to save costs. People use them to file tax returns. If questions, let us know in the comments section.

How To Get Bank Statement Online

Source: https://financemeaning.com/what-is-a-bank-statement/

Posted by: lacysaydrund68.blogspot.com

0 Response to "How To Get Bank Statement Online"

Post a Comment